Simplifying the SVB Bank fiasco

The failure of basics at SVB Bank exposes a big fault line in the economy. Let us understand this in a simple way.

There have been interesting commentary about SVB bank from my favourite experts - Danielle DiMartino Booth and Stephanie Pomboy. Kyla Scanlon does a great job explaining the issues as well. You can follow Kyla’s notes about SVB here: Kyla’s Notion notes.

I presume you know how SVB bank did not have a Chief Risk Officer for almost 6 months. SVB management is also accused of selling shares just a few months before the bank crashed.

The basics of how banks work?

Banks make money using their balance sheet. In simple terms, banks make a profit when their expenses are less than their income.

Bank Expenses

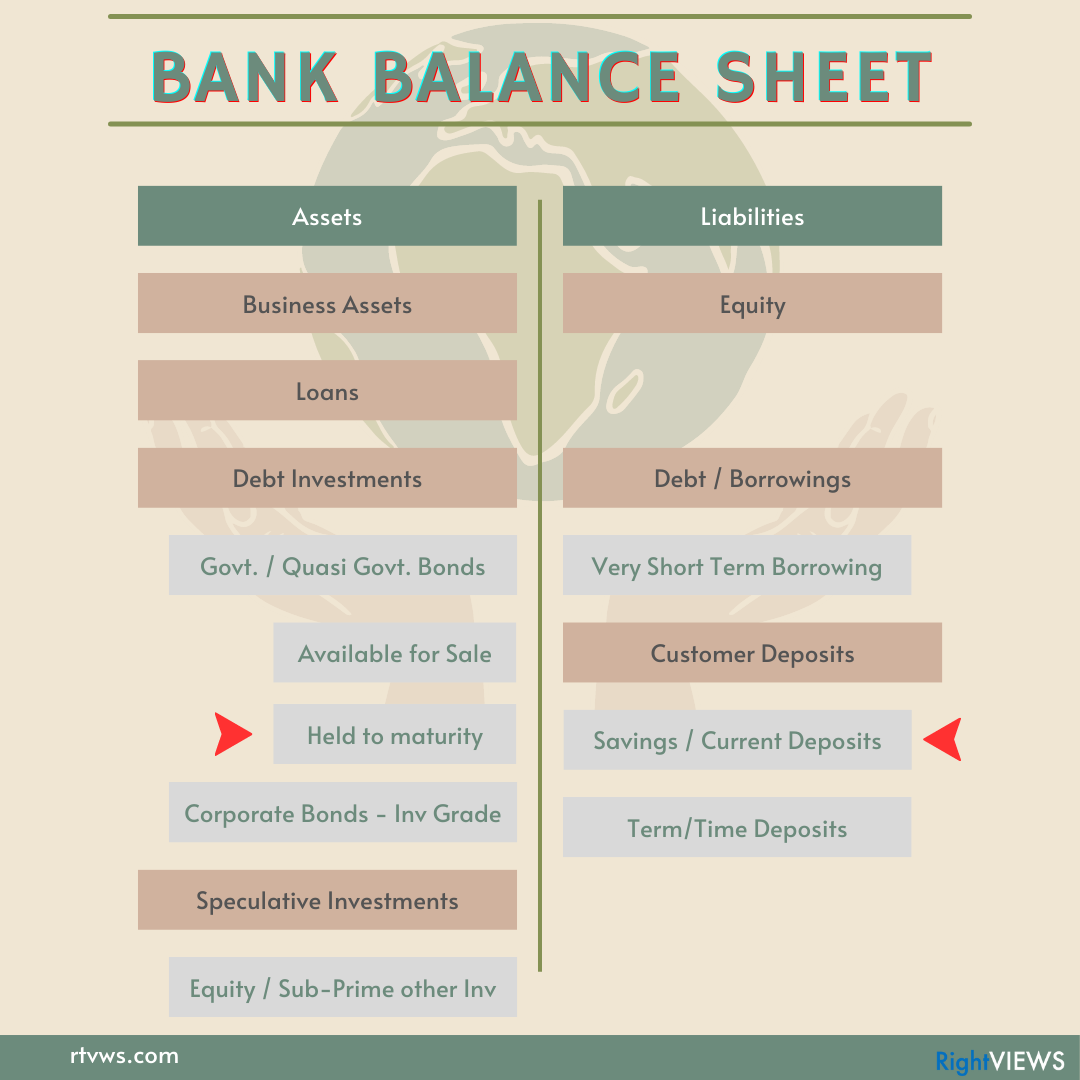

The expense for banks is the interest they pay you for the money you deposit with them. See customer deposits in the figure below. When you deposit money in the bank, it sits in this section.

Then there are other expenses like salaries etc.

Bank Income

Income for banks is the interest they earn from loans they make. So your home loans, credit card loans, all those loans sit in this category.

Banks also make money by investing their own money and their customers’ deposits and other money in various assets. One of the safest assets to invest in is the Government Bond and Quasi Government bonds (like Government guaranteed mortgages). A bit less safe but very very safe are Investment grade Bonds of companies.

Finally, banks can also invest in something speculative. It could be equity investments, commodities, or risky bonds (like subprime mortgage bonds).

The duration mismatch

We can note that the loans and investments are locked in for longer. Those are not easy to sell quickly. On the other hand, if you want to withdraw your deposits or spend your money, you can do that at any time.

That means a bank is always on edge. This time discrepancy between deposits and loans is the hallmark of banking. For any bank, if enough people rush to withdraw their deposits, they will fail. Yes, ANY bank can fail this way. This is called a Bank Run.

Over time, banks know how many people may need to withdraw their money during a particular period. So banks plan their liquidity with a lot of care and detail. Still, sometimes banks do run out of little cash, and they have to borrow for just one night or so from other banks. This money is very costly, so banks want to avoid this.

Despite the liquidity planning, despite having good investments, and quality loans, banks are always cognizant of the threat of Bank Runs.

Central Banks prevent Bank Runs on Solvent Banks.

It is the primary duty of the Central Banks to prevent bank runs by providing necessary liquidity in times of emergency.

When faced with a large number of withdrawals, the banks can lend their securities (which cannot be liquidated in a hurry) to the central bank and get cash in return. This money is lent at a certain interest rate (it is not free). This facility is called Discount Window.

To access the discount window, banks need to pledge their hard-to-liquidate assets. Fed advances them money to the extent of the market value of those assets. The rate of interest is changed during the term as per the procedure.

The Fed uses this process in the case of solvent banks, ones whose assets - loans, investments and other assets are good quality.

So what happens to insolvent banks?

A bank becomes insolvent when its assets are bad. That means the bank gave loans to the wrong people, AND/OR made bad investments AND/OR undertook some speculative activities that failed.

In this case, the government only protects the depositors through Federal Deposit Insurance Corporation (FDIC). FDIC secures deposits up to $250,000 per account. For amounts higher than $250K, FDIC issues a receivership certificate. Once the banks’ assets are sold, whatever money is recovered is divided between secured and unsecured creditors and those holding receivership certificates. This process usually takes anywhere between 6 to 24+ months.

SVB created their own mess.

SVB was the bank for Silicon Valley Startups and Venture Capital Investors. Many of their clients were cash-rich companies flush with funds. They made loans to the same group of people.

During the massive stimulus, particularly during the pandemic, we saw large funds coming to the tech sector. These funds were then invested with SVB as deposits. At the same time, the avenues for making loans did not expand. Therefore it became essential to park funds into investments. The SVB investment portfolio grew fast.

But it picked some pretty bad cards to play.

SVB insisted on exclusive client relationships.

SVB would insist through agreements and incentives that the clients have exclusive relationships with them. The clients of SVB were getting concentrated exposure to this bank.

SVB designated their investments as "Held to maturity".

The Held to Maturity designation matters very much. Once security is designated as HTM security, it cannot be sold. Typically, companies use HTM securities that pay a dividend which matches with certain pre-committed payments. Mostly, companies use US Treasury Bills / Government Bonds as HTM securities. Because these are never going to be sold, the company does not track the market price of these securities.

The investments that can be sold are held as Available for Sale (AFS) securities. These can be sold to raise money at any time. But the company has to track the price of these securities and inform the shareholders, and investors, if the value of the AFS portfolio declines or is sold.

SVB investments were highly concentrated in HTM Bonds.

While US Government Bonds have the lowest risk of default, they have price risks. When Fed raises interest rates, the value of bonds declines. Since March 2022, the Fed embarked upon an interest rate hiking cycle. This hiking cycle was well anticipated. It was a foregone conclusion that Bonds would lose value once the Fed started hiking.

SVB was playing the fiddle while the balance sheet was on fire.

Once it was clear that large amounts of investments were locked in as HTM securities, it was essential for SVB to bolster its balance sheet by raising capital. Instead, SVB was focused on sponsoring some green energy and climate change stuff.

Bad cards played badly.

Having accumulated all the bad cards, SVB played its hand poorly. SVB announced the sale of ALL its AFS securities and a vague capital raising in the form of Equity amounting to $ 2.25 billion and that a client committed funds of $500 million with their mid-quarter update on 08-Mar-2023. Ideally, the capital raising should have been almost ready to announce by this time.

As the financially savvy depositors of SVB read this, they promptly wanted to withdraw their deposits from the bank, triggering a duration risk event. Once such an event starts, it is almost impossible to control in the modern day of Twitter, online banking and the ability to go short quickly online. It is not a surprise that SVB's balance sheet withered as quickly as it did.

In Sum: We opened a can of worms.

While SVB was backstopped, Signature Bank, too, failed. Then there were contagion risks with other smaller banks coming under stress. Rumour-mongers tried to target Charles Schwab too. Across the Atlantic, Credit Suisse needed support from the Swiss authorities.

The policy response to create the Bank Term Funding Program, as different from the Fed discount window, and the economic imperatives of high inflation need to be understood separately.

There is more than meets the eye. But that will be another post.