Interesting Readings 26-Feb-2018

Some interesting readings for today:

Bank Fraud watch

Rotomac Pens fraud: How Vikram Kothari conned 7 banks; FIR details revealed

Business Standard details the fraud of Rotomac pens. Per the reading of FIR, it appears this is well established modus operandi. This scam uses rerouting money meant for processing export orders. There is also the usual siphoning off the loans by promoters going on. Usual suspects - chartered accountants, Bank officers and unscrupulous businessmen seem to be involved. Politicians are surely involved. I am also sure that such kind of scam cannot be undertaken without knowledge of RBI.

If found guilty all the directors should be sent to jail. This will force the boards of other entities to be more vigilant. There is not much cost to board members for negligence.

Meanwhile Knowledge@Wharton asks What’s Behind One of the Biggest Financial Scams in History. Thankfully that is about LIBOR scam.

Here is another way people are using for money laundering. They are selling books for $555 per book. This book is entirely gibberish.

Gulzar Natrajan asks Is corporate India failing India? which is a follow up to another article about Corporate India ethics. I venture this lack of ethics and corporate failure is why India lacks formal, salaried Jobs a question posed by Alex Tabarrok and consequently does not sustainable middle class.

Currency

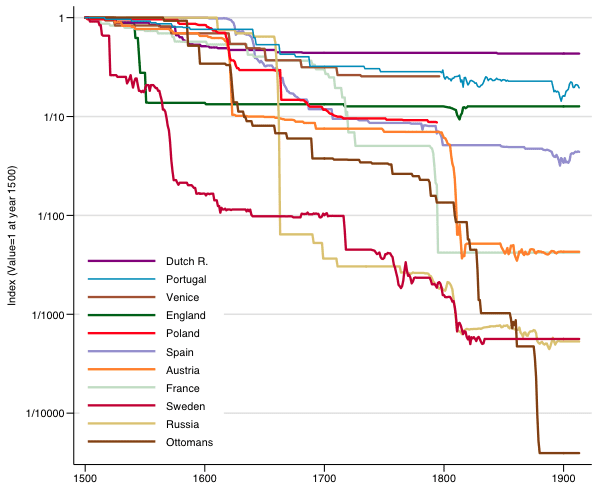

Vox has a fine post Money and monetary stability in Europe, 1300-1914 by K. Kıvanç Karaman, Sevket Pamuk, Seçil Yıldırım-Karaman

. Notable is the chart titled Index of the value of monetary unit, 1500-1914 (in silver/gold)

It leads to these three implications -

Our review of centuries of European experience offers a historical perspective on a number of ongoing debates in monetary economics. One debate concerns the relationship between technological and institutional innovations and monetary stability. Through the period we study, monetary systems were transformed more than once with the introductions of ledger, fiduciary, and fiat monies. These new monies were made possible by technological innovations in minting and printing and institutional innovations in banking and legal systems. Our findings suggest that these innovations by themselves did not necessarily make monetary systems more or less stable. Instead, depending on their fiscal capacity and political regime, states could employ the innovations to stabilise or destabilise the monetary units.

A related second debate is whether states can institute mechanisms to insulate monetary policy from politics. Historically, this debate has revolved around preventing discretionary monetary policy by adopting the gold standard, and currently, by central bank independence. Leaving aside the question of whether preventing discretion is desirable in the first place, historical evidence suggests that unless political preconditions are satisfied, it is not feasible. In particular, we find that neither the gold nor the earlier silver standard was a hard commitment. On both standards, states retained the prerogative to reset the silver or gold equivalent, or switch to fiat standard altogether. Consequently, when silver or gold standards kept the monetary units stable, it was ultimately because the underlying politics favoured stability.

A third debate concerns whether the state can be shut out of the monetary system altogether. Historically, the debate has centred on the feasibility of monies issued by private institutions, and currently, digital currencies. The long-run evidence suggests that the prospects for privately run monetary systems are dubious. Historically, it was private banks, goldsmiths, and moneychangers that innovated and developed new forms of money. States, however, sooner or later appropriated and monopolised these innovations, supported or banned them, and retained the control over the monetary system. Money was, and arguably will continue to be, too important to leave to private prerogatives.

The paper is must read.

Interesting Working Papers to read

Some more working paper recommendations by V Ananthanageswaran who recommends a few

Can poverty be alleviated in China?,

Regulatory Soft Interventions in the Chinese Market: Compliance Effects and Impact on Option Market Efficiency,

Government Affiliation and Fintech Industry: The Peer-to-Peer Lending Platforms in China

Credit Allocation Under Economic Stimulus: Evidence from China

Bank Competition and Innovation: Evidence from Banking Deregulation in China

Buy my books "Subverting Capitalism & Democracy" and "Understanding Firms".